So why your super matters now…

Superannuation isn't just something for when you're ready to retire—it’s your ticket to financial freedom, and the sooner you start making smart choices, the better. Australians are living longer and facing rising costs of living, so planning for your future super can make a huge difference to the lifestyle you’ll enjoy down the road. The earlier you take control of your super, the more you can maximize its growth and secure your financial future.

Did you know? The average Australian spends about 18 years in retirement, but the average super balance at retirement is around $400,000 (according to the Association of Superannuation Funds of Australia - ASFA). If that sounds low, that’s because it is. But it gets worse. The median balance (eg the balance that has the most people retire with) is much lower at a little less than $210,000! Which is well below the recommended balance…

But with these 6 simple strategies, you can boost your super and ensure you have the funds to live comfortably.

Making small changes now can lead to a big difference at retirement.

Here’s how you can get started:

Contribute more to your super: Every extra dollar you contribute can grow significantly over time, thanks to compound interest. Even small, regular contributions add up! This can be done via post-tax or pre-tax contributions, but either way, the more inside the more money saved for tax as super funds are taxed at lower rates than outside super.

Consider salary sacrifice: By redirecting a portion of your pre-tax salary into your super. This has the dual benefit of lowering the income tax you pay, but also help you build super faster, and lowers the tax paid on earnings of your money. Just let your employer know and they can add extra to your super fund of choice.

Check your investment options: Your superannuation fund will offer a range of investment options—make sure you're in the one that suits your goals. It’s very common for people to not elect any investment type and hence get the garden variety super performance which is typically a low risk option. This can mean a much lower return over many years. Therefore, if you’re years away from retirement, you may want to consider higher-growth options to maximize your super balance.

Consolidate your super funds: If you’ve had multiple jobs over the years, you may have more than one super fund. Happens very often. Consolidating them into a single fund can save you on fees (admin fees especially) and make managing your super easier. It is crazy, that the average Australian has on, 2.7 super accounts. Consolidation can ensure you’re not paying unnecessary fees.This can be done by going to https://moneysmart.gov.au/how-super-works/find-lost-super.

Review your fees: Super funds charge fees for managing your money, but they vary widely. Make sure you’re not overpaying for services you don’t need. For instance, some super funds charge 1-2% of your balance per year in fees, but you can find funds with lower fees that offer similar services. Just think about it … if you have a fund with the average amount of $400,000, this means in excess of $4000 per year in fees. Or $60,000 over 15 years. (Nb this would typically be more as the value of the investment went higher). When you put it like this you can realise how much of your retirement you will lose simply through fees!

Understand super fund types.

When it comes to choosing the right super fund, there are a few options to consider:

Industry Funds: These are not-for-profit funds designed for specific industries (e.g., healthcare, construction). They usually offer lower fees and are good for people who want a hands-off approach to super. Many also provide strong investment returns.

Retail Funds: These are for-profit funds run by financial institutions. They may offer a wider variety of investment options but tend to charge higher fees. Retail funds may be worth considering if you want more flexibility or professional advice.

Self-Managed Superannuation Funds (SMSFs): These funds allow you to take control of your super investments. If you’re interested in managing your own investments and are willing to invest time and resources into understanding your options, SMSFs may suit you. However, they come with higher setup and maintenance costs, and therefore they won’t suit everyone.

Common questions about super.

Here are a few common questions Australians ask about super:

What are the different types of fees in my super fund? Fees can vary significantly between funds. Generally, you’ll pay an administration fee, investment fee, and sometimes an insurance fee(s). Some funds charge flat fees, while others charge a percentage of your balance. Always check how much you’re paying—if your balance grows, fees can take a larger bite out of your returns.

Should I be worried about my super's performance? Super funds are designed to grow over the long term, so short-term fluctuations are normal. However, if your super fund has been underperforming for several years, it may be time to review your options. Underperformance would be determined by understanding what the ‘market’ return was for that same market. For example, if you had invested in Australian shares, what was the overall return for that sharemarket and did your fund beat that? Especially to be considered when fees are included in your return assessment.

What are the different investment options in my super? Your super fund will typically offer a range of investment options, including conservative, balanced, and growth portfolios. The higher the risk, the higher the potential return. Generally, the younger you are, the more risk you can afford to take. However, it is also important to remember that even in retirement you will need your investments to work for you, now that you are no longer working. We see very often people becoming too conservative in retirement – not realising the length of time that are investing with too little in terms of growth assets.

Should I consolidate my super? If you have multiple super accounts, consolidating them into one can save you money on fees and simplify your retirement planning. But make sure to check if there are any exit fees, insurance coverage or other major features that you might lose by consolidating. Remember to also make sure you get your super contributions re-directed to a new fund. This is called a ‘Standard Choice Form’ and lets your employer know where to send your super.

How small changes today can lead to big differences at retirement

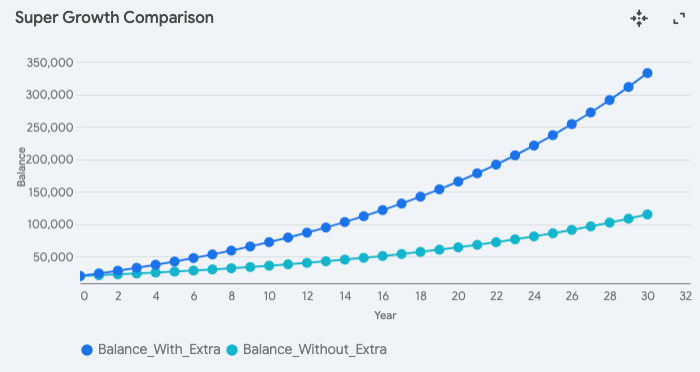

Let’s look at an example to illustrate how small changes can make a big impact over time:

Example: Sarah’s Super Growth

Current super balance: $20,000

Contributions: Sarah adds an extra $50 per week (compared to doing nothing)

Growth rate: 6% p.a. (average return)

Time frame: 30 years

Without the extra $50 per week, Sarah’s super would grow to approximately $114,000. But with the extra $50 per week, it would grow to around $320,000 because of the compounded growth on the additional weekly contributions.

That’s around $206,000 difference simply by adding $50 each week. This compares to the actual amount for those weekly contributions be only $78,000. The difference between the two is the power of compounding and illustrates how important regular contributions and compounding is over time.

Why this matters?

Compounding power: The relatively small weekly amount creates significant growth over time

Early contributions matter: The longer your money can grow, the more dramatic the results

Consistent saving helps: Regular contributions build wealth steadily without requiring large lump sums

When to seek professional financial advice

Here are some warning signs that it might be time to consult a financial planner:

You’re unsure about how your super is invested or whether you’re paying too much in fees.

You’ve recently changed jobs or have multiple super accounts and are unsure whether to consolidate them.

You want to develop a clear strategy for maximizing your super contributions, especially if you’re closer to retirement.

You’re overwhelmed by the decision of whether to pay off a loan or add more to super and don’t know which is best for you.

The value of financial advice

While managing your super yourself is possible, a financial planner can add significant value, especially when it comes to making informed decisions. A financial planner can:

Help you choose the best investment options for your goals based on the process of discovering your risk tolerance.

Provide advice on tax-effective strategies, like salary sacrificing and making after-tax contributions. A good planner will ensure that your tax savings can add much more to your pocket than any fees taken out.

Help you create a retirement plan that accounts for all your financial needs.

Keeps you informed of all the regulatory changes that may be relevant to your circumstances.

With the right advice, you can make the most of your super and ensure you're on the right path toward financial freedom.

What happens to my super when I retire or die?

· When you retire: Upon retirement, you can choose how to access your super. You can take it as a lump sum or set up an income stream (e.g., pension). You can even leave it in your super fund and access it later. It’s important to consider the tax implications of each option to ensure you get the most from your super.

· If you pass away: When you die, your super will generally be paid to your nominated beneficiaries. The super fund will handle the distribution, and if you haven’t nominated anyone, your fund will distribute the super based on their rules or legal direction. It’s important to keep your beneficiary nominations up to date (some funds have these lapse) to ensure your super is paid to the right person.

Tip for the day!

Would you like to get the Government to give your super fund $500? Then read on…

If you earn less than $45,400 and meet the eligibility requirements (got to ATO website), simply add up to a limit of $1,000 into your super and the government will match this with a further $500. Pretty neat trick huh…!?!. This is known as the government co-contribution….

Note if you earn slightly, more than this (but meet the other eligibility criteria) you may still be eligible for the co-contribution. It will just be reduced according to the formula of 3.33c for every dollar over $45,400 of income.

This needs to be after tax contribution, so salary sacrifice or super guarantees are not included in this. Money sitting in a bank account outside of super, that is contributed to super is allowed.

MAKE SURE YOUR SUPER FUND KNOWS YOUR TFN!

Superannuation FAQs

What is superannuation?

Superannuation is a way of saving for retirement. Employers pay a percentage of your salary (currently 11.5%) into your super fund, which is then invested to grow over time. Nb this is going up to 12% on 1st July 2025What happens if I don’t make extra contributions to my super?

If you rely solely on the compulsory employer contributions, you might not have enough to live comfortably in retirement. Adding extra contributions (even small ones) can make a big difference.How do I choose the right super fund?

Look at factors like fees, investment options, performance history, and the level of customer service. Consider your retirement goals and whether you want a hands-off or more active approach to managing your super.Can I access my super early?

In general, you can access your superannuation when you reach your preservation age and retire, or when you turn 65, even if you’re still working. The preservation age varies depending on when you were born.

· If you were born before 1 July 1960, your preservation age is 55.

· If you were born after 1 July 1964, your preservation age is 60.

Keep in mind that you can't access your super earlier unless you meet specific conditions, such as severe financial hardship or illness. It’s important to plan your super withdrawals wisely to ensure you’re financially secure in retirement.